BELLRING BRANDS (BRBR)·Q1 2026 Earnings Summary

BellRing Brands Stock Crashes 6% as Gross Margins Collapse and CEO Announces Retirement

February 3, 2026 · by Fintool AI Agent

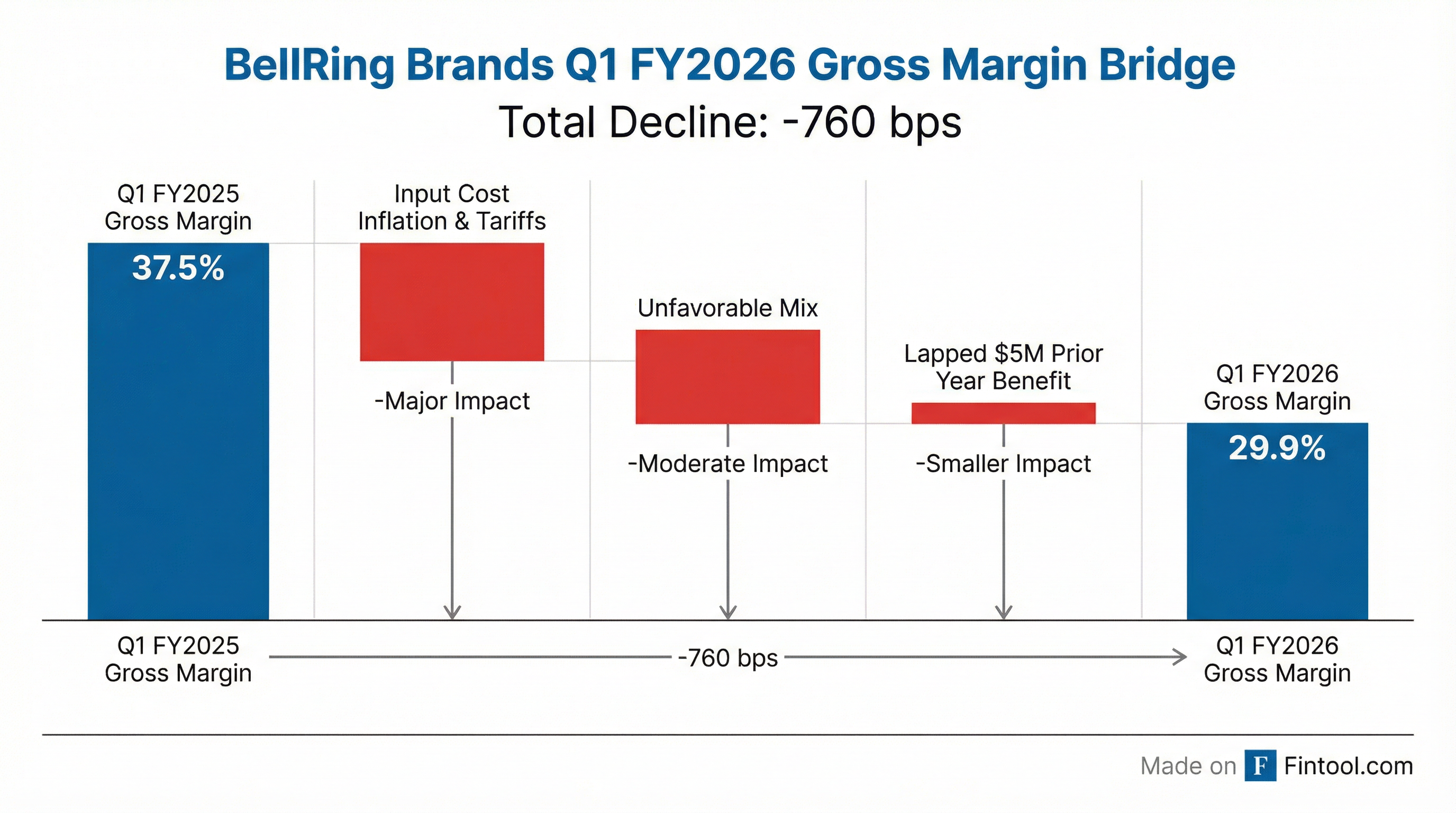

BellRing Brands (NYSE: BRBR) reported Q1 FY2026 results that sent shares tumbling 5.7% after-hours to $23.00. While revenue of $537.3 million edged up 0.8% year-over-year, the real story was a brutal gross margin collapse of 760 basis points to 29.9%—driven by tariffs, input cost inflation, and unfavorable mix . Adding to investor concerns, CEO Darcy Davenport announced her retirement, effective by September 2026 .

Did BellRing Beat Earnings?

The quarter delivered mixed signals. Management characterized results as "ahead of guidance" due to favorable timing of customer orders , but profitability metrics deteriorated sharply:

The 760 basis point gross margin compression was the quarter's defining issue. Management attributed it to "significant input cost inflation, inclusive of tariffs, unfavorable mix and lapping $5.0 million of non-recurring cost favorability in the prior year period" .

What's Driving the Margin Collapse?

Three factors crushed gross margins this quarter:

-

Tariffs and Input Cost Inflation: Management cited "significant input cost inflation, inclusive of tariffs" as the primary driver . Whey protein costs have been volatile, and new tariff pressures are compounding the issue.

-

Unfavorable Mix: Product mix shifted toward lower-margin items, with Premier Protein RTD shakes down 2.2% on consumption while Dymatize (which typically carries different margin profiles) grew 15.8% .

-

Lapping Prior Year Benefits: Q1 FY2025 had $5.0 million in non-recurring cost favorability that didn't repeat .

This margin trajectory is concerning. Looking at the trend over recent quarters:

*Values retrieved from S&P Global

What Did Management Guide?

BellRing narrowed its FY 2026 outlook, notably trimming the high end of both revenue and EBITDA ranges :

Management attributed the guidance reduction to "increased category promotional frequency and higher whey protein costs" . However, they maintained that "net sales growth is expected to accelerate beyond the first quarter as merchandising initiatives, advertising and innovation become more meaningful" .

What's the Consumption Outlook?

A key concern heading into the call was Premier Protein consumption trends. Management provided encouraging near-term data:

- January all-channel consumption: +6%

- January ex-club consumption: +16%

- Q1 Premier RTD consumption: -2% (lapping +23% prior year)

- Q1 ex-club consumption: +11%

CFO Paul Rode noted Q2 consumption is expected to "be generally in line with net sales" (3-4% growth), with "growth strategies to be more meaningful contributors to growth in the second half of the year" .

How Is the Mass Retailer Program Performing?

The mass merchandiser test—designed to prove Premier Protein belongs outside the pharmacy section—is yielding strong early results:

"The program is performing very well. We absolutely internally view this as a success... We're seeing record weekly sales on the rollback items. January was our largest month ever at this retailer."

CEO Davenport highlighted they now have "up to seven displays throughout the store" at participating locations . Singles sales have "more than doubled in January" , effectively increasing trial. The company is now taking these learnings to pitch expanded programs to other food, drug, and mass customers.

What's the Competitive Landscape?

Management broke down the RTD shake category competitive dynamics :

On promotional intensity, Davenport was direct: "The category actually, it's usually not that promotionally driven... about 25%-30% sold on deal. Having said that, this year is higher." She attributed this to insurgent brands "spending a ton of money on demos, on promotion, displays" to gain trial .

Management expects this is "a point in time" rather than the new normal, with consolidation around best-performing brands eventually reducing promotional intensity .

What's in the Innovation Pipeline?

Management teased an aggressive 2026 innovation roadmap:

Coffeehouse Line (Launched Q1): 30g protein + caffeine equivalent of one cup of coffee. "Early, early results are promising," with Caramel Macchiato as "one of the highest velocity 4-counts in January" . A variety pack launches at a club retailer this month.

Higher Protein Line (H2 2026): A product with higher protein levels "for those consumers looking for more protein in their ready-to-drink shake" .

Mystery Line (Late FY2026): Davenport teased a new line offering "a completely different drinking experience versus our core products." She noted it "tested well above industry benchmarks and targets both incremental consumers and incremental occasions" .

CEO Darcy Davenport Announces Retirement

In a significant leadership change, CEO Darcy Davenport announced her retirement, effective on the earlier of a new CEO appointment or September 30, 2026 .

Davenport reflected on her tenure during the call:

"17 years ago, I joined a privately held company with approximately $20 million in sales. Today, we are a publicly traded, global $2.3 billion business with significant runway still ahead of us. While the growth is remarkable, what I'm most proud of is the culture we have built along the way."

She committed to remaining "fully committed to helping BellRing Brands achieve its full potential" and will serve in an advisory role following the appointment of her successor .

The company stated the retirement "did not result from any disagreement with the Company on any matter relating to its operations, policies or practices" . The Board has commenced a national external search for her successor .

How Did the Stock React?

BRBR shares have been under significant pressure:

- Pre-earnings close: $24.39

- After-hours: $23.00 (down 5.7%)

- 52-week high: $79.57

- 52-week low: $21.67

- YTD decline: ~70% from highs

The after-hours drop reflects investor concern over the margin trajectory, guidance reduction, and CEO transition uncertainty. The stock is now trading near 52-week lows.

What Changed From Last Quarter?

Several key shifts emerged compared to Q4 FY2025:

The Premier Protein RTD consumption decline of 2.2% is notable, though management attributed it to "tough prior year comparisons in the club channel including non-repeating promotions" . Excluding club, Premier Protein RTD growth was +11% .

Capital Allocation: Buybacks Continue

Despite margin pressures, BellRing continued aggressive share repurchases:

- Q1 FY2026 buybacks: 3.0 million shares for $96.9 million at an average price of $31.95

- Remaining authorization: $543.1 million

The company repurchased approximately 2.5% of shares outstanding in the quarter . However, with the stock now trading at $23, these buybacks are underwater relative to the $31.95 average purchase price.

Key Risks to Watch

-

Tariff Exposure: Management explicitly called out tariffs as impacting input costs . Further trade policy changes could exacerbate margin pressure.

-

Whey Protein Costs: The guidance reduction cited "higher whey protein costs" , suggesting input cost inflation may persist.

-

CEO Transition: Leadership changes during a challenging operating environment add execution risk.

-

Club Channel Dependence: BellRing remains heavily exposed to the club channel, where promotional dynamics can swing results significantly .

-

Manufacturer Concentration: Nearly half of RTD protein shakes come from a single manufacturer .

Q&A Highlights

On the advertising campaign (Morgan Stanley): The new "Go Get 'Em" campaign launched in late December "tested better than any other prior campaign" and runs across linear TV, streaming, podcast, social, retail media, and out-of-home including gyms . Management expects a "couple of months" lag before advertising impacts consumption .

On club channel shakeout (J.P. Morgan): Asked about smaller brands filtering out of club, Davenport confirmed: "We're actively watching repeat rates. We have already seen some brands not make it, especially in club, because those thresholds are very high" .

On promotional rationality (Jefferies): Davenport addressed whether insurgent brand behavior is irrational: "Some of the insurgent brands are less rational... they're spending to try to get their foothold in the category." She characterized this as "a point in time" land grab rather than the new normal .

On M&A appetite (TD Cowen): When asked about potential M&A of insurgent brands, Davenport said they're "evaluating consumer metrics to see if there are any that we think would be interesting add-ons to our business. We're always looking at both organic and inorganic growth" .

On innovation capacity (Deutsche Bank): Regarding manufacturing capacity for new products, Davenport noted: "Some of our innovation is absolutely leveraging our existing co-manufacturers, but some of our innovation is looking at new co-manufacturers... We have a national network of co-mans. We know every single co-man that makes a protein-type product" .

On Dymatize international (Bernstein): CFO Rode highlighted Dymatize's strong international performance in the Middle East, South America, and Central America, with Q1 coming in "better than expected." He noted the competitive set internationally "is a little bit different, a little less intense perhaps than you see in the US" .

The Bottom Line

BellRing's Q1 FY2026 was a challenging quarter that exposed the company's vulnerability to input cost inflation and tariffs. While revenue held relatively steady, the 760 bps gross margin collapse signals structural cost pressures that may take time to resolve. Combined with a narrowed guidance range and the surprise CEO retirement announcement, investors have reason for caution.

The investment thesis now hinges on whether BellRing can: (1) stabilize margins as cost pressures moderate, (2) execute a smooth CEO transition, and (3) reignite top-line growth in the back half of FY2026 as promised. Management's confidence that "net sales growth is expected to accelerate beyond the first quarter" will be tested in coming quarters.

Related Documents: